Will Ukraine have the last laugh?

Actor and comedian Volodymyr Zelensky was elected as Ukraine's president in April. Though the result came as a shock, the mood in the country is still largely one of optimism that its investor appeal will endure, Courtney Fingar discovers.

Shock election results are becoming a global norm. So too is the ushering into office of political novices. Ukraine became the latest democracy to embrace this trend, with its voters opting for a 41-year-old television actor and comedian with no political experience over a five-year incumbent in April’s presidential elections.

In a head-to-head runoff, Volodymyr Zelensky vanquished Petro Poroshenko and officially took office as the sixth president of Ukraine on May 20. Mr Zelensky enjoys initial strong popular support, having captured more than 72% of votes and swept most regions of the country. But with parliamentary elections looming in July, it is not yet clear what kind of a mandate he will have or how amenable the political environment will be for any policies he plans to push through. In all likelihood his virtual ‘Servant of the People’ party will be forced into a coalition in order to govern. It is equally hazy what precisely his policies will consist of.

After running on a suitably vague anti-corruption, pro-jobs platform, the new president will have found a daunting in-tray waiting in his office and more questions than answers exist at this stage about how he will tackle Ukraine’s mountain of problems. These include everything from a lingering war with Russia in eastern Ukraine to debt negotiations with the IMF.

Down to business

But, as ever with Ukraine, the only thing bigger than its set of problems is the size of its potential. Observers will be eagerly watching to see if the fresh-faced president can be the one to finally unlock it. Central to this will be pressing ahead with reforms to the judiciary, regulatory framework and business environment. Disappointment with the slow pace – or absence, as pessimists argued – of change under Mr Poroshenko was a primary reason for his defeat, so voters are unlikely to afford a huge amount of patience to his successor. They will want to see results, and soon. So will the business community.

Ukraine is ranked 71 among 190 economies in the World Bank’s Doing Business 2019 study. In the Ease of Business score, Ukraine scores 68.25 out of 100, behind the regional average for Europe and Central Asia and lower than neighbours such as Belarus and Moldova. Its change in score in the past two years is only 0.94%.

However, the general trajectory post-2014 – when Mr Poroshenko took office after the 'Maidan revolution' – has been down a path of reform, and improvements to the business environment in recent years have already helped to unlock more than $1bn from existing investors, according to UkraineInvest, the national investment agency. Mr Zelensky is widely expected to stick to that path and to continue to maintain a pro-European, internationalist stance. Markets have remained watchful but calm.

"I think the macroeconomic stabilisation, debt stabilisation and currency stabilisation will continue," says Daniel Bilak, chairman of UkraineInvest. "That’s why you haven’t seen yields appreciatively change on government bonds and sovereign debt. We have seen continued robust interest on the part of investors in coming to this country. Everybody wants to wait, understandably, until after the parliamentary election campaign though."

Decentralisation drive

Among the reforms launched in 2014 was a process of decentralisation, which handed greater powers to local authorities as a means of spurring regional development. Ukraine’s city leaders have all urged that the decentralisation programme be protected.

"What is most important to us is that decentralisation continues. A lot of power was given to local governments and this is right," says Mykola Povoroznyk, first deputy head of Kiev’s city administration. "But we’re waiting, of course, to see what happens."

Mr Povoroznyk says improvements to the laws surrounding public-private partnerships (PPPs) are also necessary. "Up to now not a single PPP project is ready to be realised because the law is simply not attractive to foreign investors," he adds.

FDI resilience

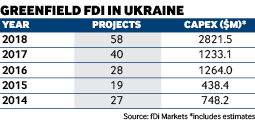

Despite its past turmoils and regulatory imperfections, investor interest in Ukraine has remained more durable than might be expected. After a dip in 2015 following the previous year’s Maidan revolution and start of conflict of Russia, FDI in Ukraine has been on the rise. According to greenfield investment monitor fDi Markets, the number of inbound greenfield investment projects in the country increased to 58 in 2018, compared with 40 in 2017, 28 in 2016 and only 19 in 2015. Capital volume for these investments grew from an estimated $438m in 2015 to $2.8bn in 2018.

fDi Markets finds that the most popular FDI sectors in Ukraine are software and IT services (accounting for 21% of greenfield FDI projects between 2014 and 2018), agribusiness (18%), industrial equipment and renewable energy (both 12%). The IT sector is a clear strength for the country and often cited among its most notable success stories. Its investment appeal is based on its favourable cost-quality ratio, with companies able to source highly qualified workers at a reasonable rate – though brain drain is something Ukraine has to constantly guard against. A study by fDi Benchmark, a location assessment tool using independent data points to compare investment destinations, puts Ukraine at number one for attractiveness for IT technical support centres when measured against other central and eastern European locations – ahead of Poland, Romania and Czech Republic.

"There’s an understanding in this country that our greatest asset is our people. I always say that Ukraine’s greatest asset is ‘grains and brains’. The brains part is really taking off. Ukraine's IT sector was worth $110m in 2003; it’s now worth $4.5bn and is our third largest export," says Mr Bilak. "Many of these are start-ups but these are companies that continue to mature. As we see larger multinational companies enter the market they start with R&D centres and then they’ll slowly move into manufacturing, because you learn by doing, you learn by making things.

"That’s our continued challenge here at Ukraine Invest: to make sure that we get high-quality investors who are going to continue to make high-added-value investments in the country to move it up the value chain as we move the economy into the 21st century."

Global greenfield investment trends

Crossborder investment monitor

|

|

fDi Markets is the only online database tracking crossborder greenfield investment covering all sectors and countries worldwide. It provides real-time monitoring of investment projects, capital investment and job creation with powerful tools to track and profile companies investing overseas.

Corporate location benchmarking tool

fDi Benchmark is the only online tool to benchmark the competitiveness of countries and cities in over 50 sectors. Its comprehensive location data series covers the main cost and quality competitiveness indicators for over 300 locations around the world.

Research report

fDi Intelligence provides customised reports and data research which deliver vital business intelligence to corporations, investment promotion agencies, economic development organisations, consulting firms and research institutions.

Find out more.